The Ultimate Guide To Bank Definition

Wiki Article

An Unbiased View of Bank Draft Meaning

Table of ContentsBanking Can Be Fun For AnyoneBanking for Beginners9 Simple Techniques For BankThe smart Trick of Bank Certificate That Nobody is Talking About

You can likewise save your cash and also gain rate of interest on your investment. The cash kept in most financial institution accounts is government insured by the Federal Down Payment Insurance Coverage Corporation (FDIC), approximately a limitation of $250,000 for private depositors as well as $500,000 for jointly held down payments. Financial institutions additionally give credit report possibilities for individuals as well as firms.

Banks make a profit by charging even more rate of interest to borrowers than they pay on cost savings accounts. A bank's dimension is determined by where it lies and also who it servesfrom small, community-based institutions to large industrial financial institutions. According to the FDIC, there were just over 4,200 FDIC-insured business banks in the United States since 2021.

Ease, interest rates, and also costs are some of the factors that aid customers determine their liked financial institutions.

The smart Trick of Bank Reconciliation That Nobody is Talking About

The governing atmosphere for banks has actually since tightened considerably as an outcome. United state banks are managed at a state or national degree. State financial institutions are managed by a state's department of banking or department of economic organizations.

You must consider whether you wish to keep both service as well as individual accounts at the same financial institution, or whether you desire them at separate financial institutions. A retail bank, which has basic financial services for consumers, is the most suitable for day-to-day financial. You can select a conventional bank, which has a physical structure, or an online financial institution if you do not desire or require to physically see a bank branch.

A neighborhood bank, for instance, takes deposits and provides in your area, which can offer a much more personalized banking connection. Pick a convenient location if you are choosing a bank with a brick-and-mortar place. If you have an economic emergency, you don't desire to need to travel a far away to get cash money.

The 7-Minute Rule for Bank Definition

Some financial institutions additionally supply smart device applications, which can be helpful. Inspect the costs related to the accounts you bunk bed wish to open. Banks bill rate of interest on lendings along with month-to-month upkeep charges, over-limit charges, and cord transfer check this site out fees. Some huge banks are relocating to finish overdraft fees in 2022, to ensure that could be a crucial consideration.Financing & Development, March 2012, Vol (bank account number). 49, No. 1 Organizations that compare savers and also debtors assist make sure that economic situations operate efficiently YOU have actually got $1,000 you do not require for, state, a year and also desire to earn income from the cash till after that. Or you wish to get a residence as well as require to borrow $100,000 and also pay it back over three decades.

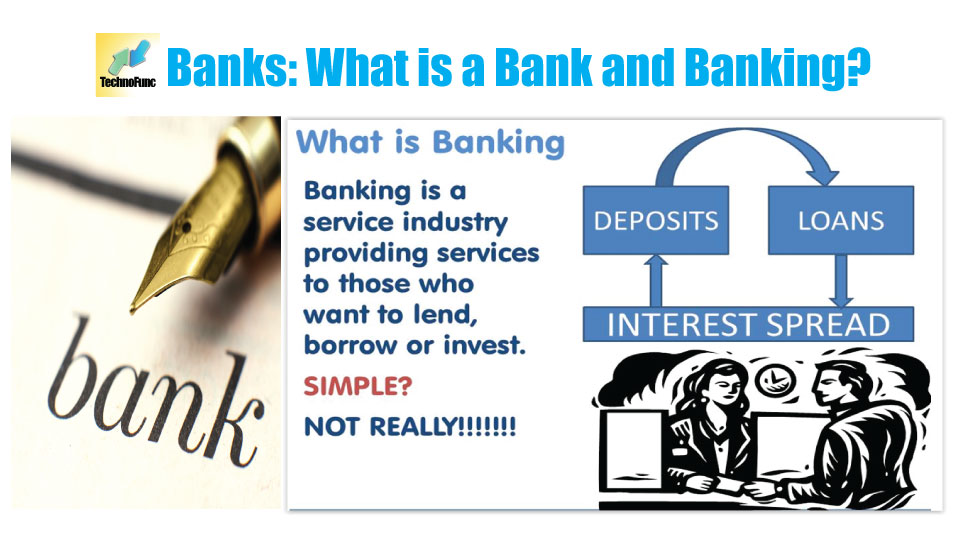

That's where financial institutions are available in. Although banks do several points, their primary role is to take in fundscalled depositsfrom those with money, pool them, as well as offer them to those who need funds. Banks are intermediaries in between depositors (who offer cash to the bank) as well as consumers (to whom the financial institution lends money).

Depositors can be people and also families, economic and nonfinancial firms, or national and also city governments. Borrowers are, well, the exact same. Down payments can be readily available on need (a bank account, for instance) or with some constraints (such as cost savings as well as time down payments). While at any provided moment some depositors need their money, most do not.

Everything about Bank Reconciliation

The process involves maturity transformationconverting temporary obligations (deposits) to lasting assets (fundings). Financial institutions pay depositors less than they get from customers, which difference represent the mass of financial institutions' earnings in a lot of countries. Financial institutions can match standard down payments as a resource of financing by straight obtaining in the money and resources markets.

Financial institutions keep those required books on down payment with central banks, such as the U.S. Federal Reserve, the Bank of Japan, as well as the European Central Bank. Banks develop cash when they provide the remainder of the cash depositors provide. This cash can be utilized to buy products and services and can locate its back right into the financial system as a down payment in another financial institution, which then can offer a portion of it.

The size of the multiplierthe amount of cash developed from an initial depositdepends on the amount of cash banks should go on reserve (bank code). Banks also lend as well as recycle excess cash within the economic system and also develop, disperse, and also trade safeties. Financial institutions have several ways of making cash besides swiping the difference (or spread) between the interest they pay on down payments and obtained money and also the rate of interest they accumulate from debtors or securities they hold.

Report this wiki page